Crypto Banking

Category

Mobile app

Industry

Fintech

Role

Product Designer

Traditional banking meets crypto

Yapı Kredi, Turkey’s fourth largest bank, aimed to bring crypto into everyday banking. Despite being an early mover, the brand struggled to deliver a seamless experience—calling for a refreshed vision that connects trust with innovation.

Problem Statement

Although crypto adoption in Turkey is rising fast, users remain skeptical of existing platforms: exchanges are seen as unsafe, complex, and “casino-like.” Yapı Kredi faced the challenge of designing a trusted, simple, and secure crypto banking experience that could reassure customers while differentiating from both local banks and global exchanges.

Vision

The new app was designed with one clear vision: make crypto banking as easy and reliable as checking your balance.

- Buy, sell, transfer, and save crypto with zero fees

- Seamless cold wallet integration for maximum security

- Competitive yet intuitive design informed by research and benchmarks

Discovery

Research users and business requirements about crypto features. Determine task facing product and user to examine list of cases for application and base on that create the application architecture and navigation.

🔍

Project Goals

Minimizing the problems faced by the new comers for crypto ecosystem by creating an app

👥

User Goals

Buy, sell or transfer

crypto easy and secure way they used to

🎯

Target Users

Aimed for people who dont want to miss benefits of crypto investment.

User interviews

A user survey was conducted to determine how potencial customers thinking about crypto currencies. Some of their frustiration listed below

Key findings from our conversations

check

Complaints against crypto exchanges rise in globally

check

Confusion around safe storage

check

Exchanges described as “hard to use, easy to lose”

check

Security fears

User research

24 responses analyzed across 19 data points revealed core user groups:

👨💼

Young professionals & students

💰

High-income investors

💹

Forex traders

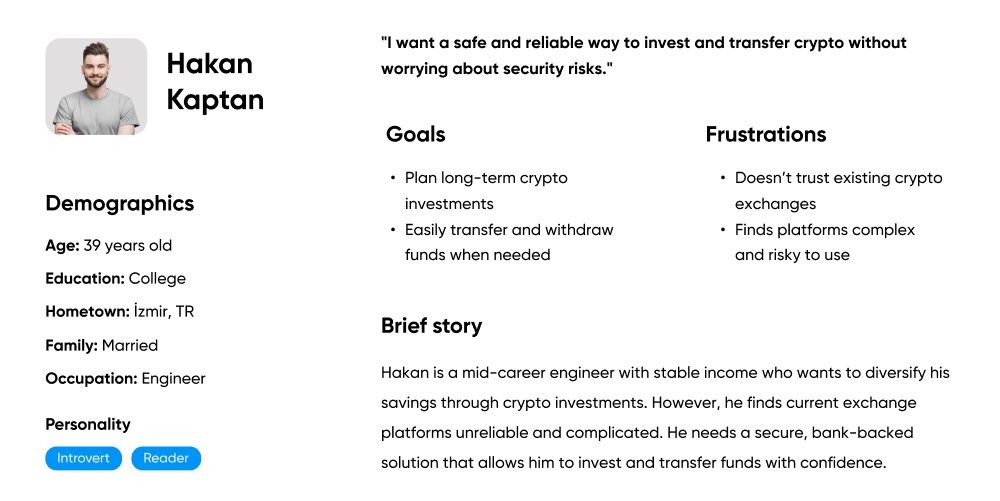

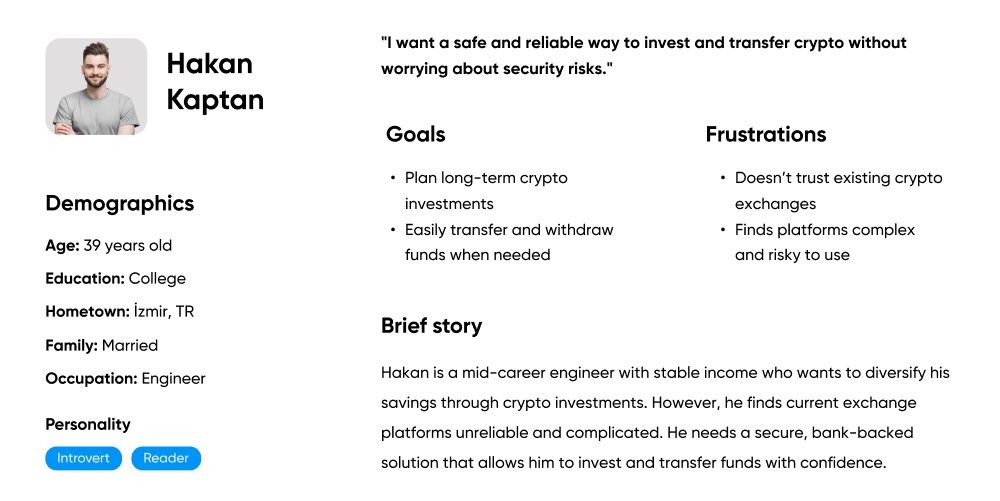

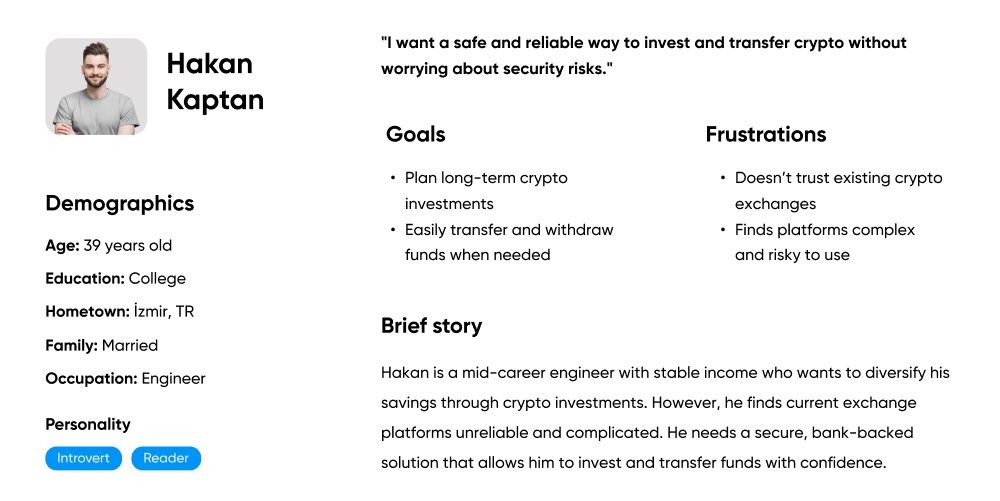

Persona

To synthesize my research findings and my target user's needs and goals, I established my primary persona, "Hakan". This persona will help inform my design process going forward, ensuring I make decisions with him in mind.

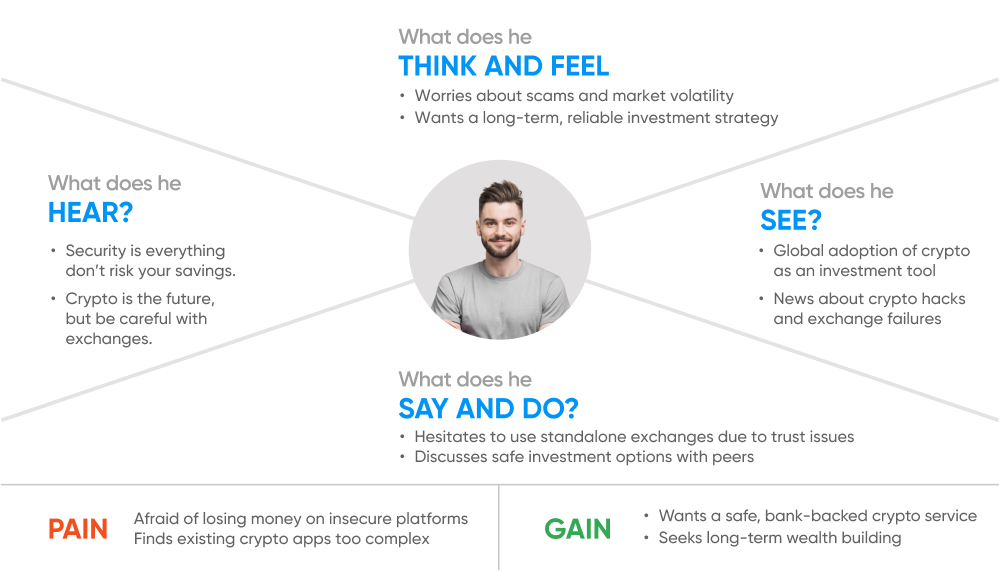

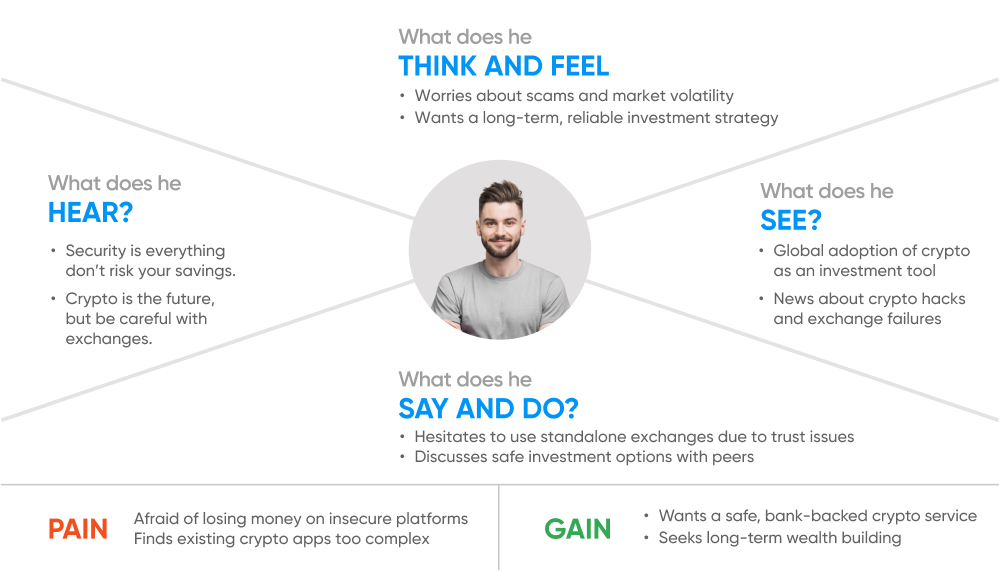

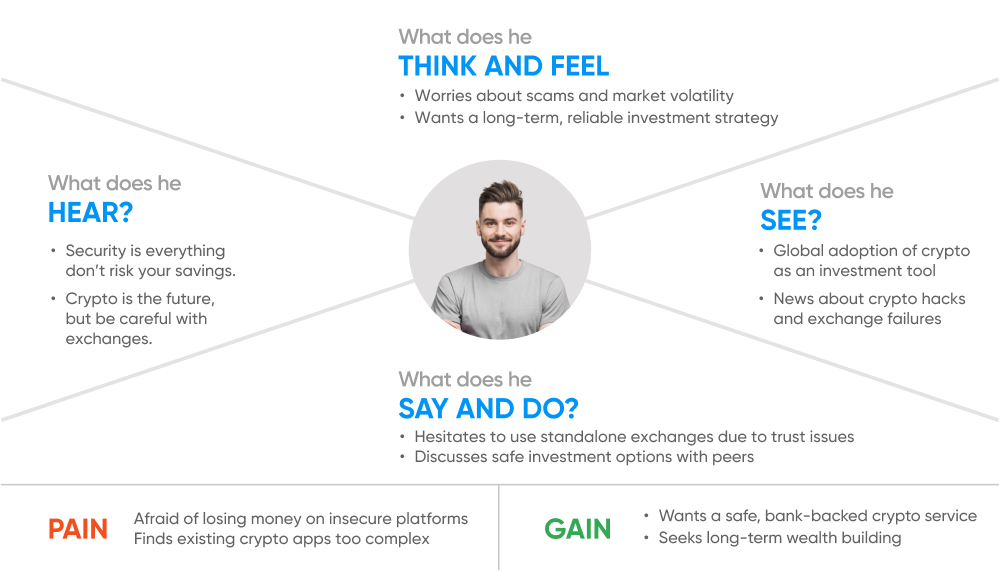

Empathy Map

To gain a deeper understanding for my primary user's wants and needs, I reviewed my notes and observations taken during my 1:1 interviews and developed this empathy map.

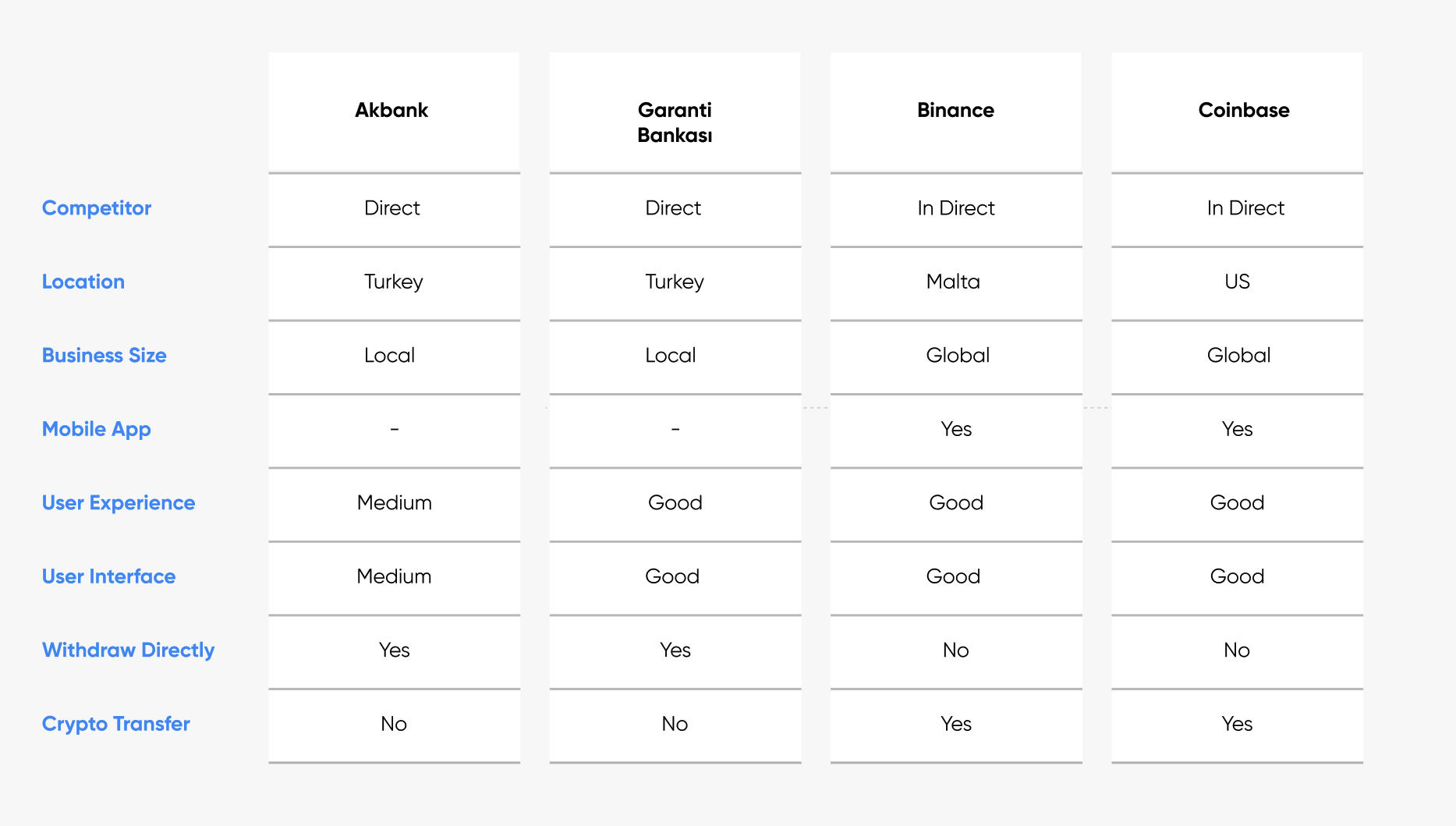

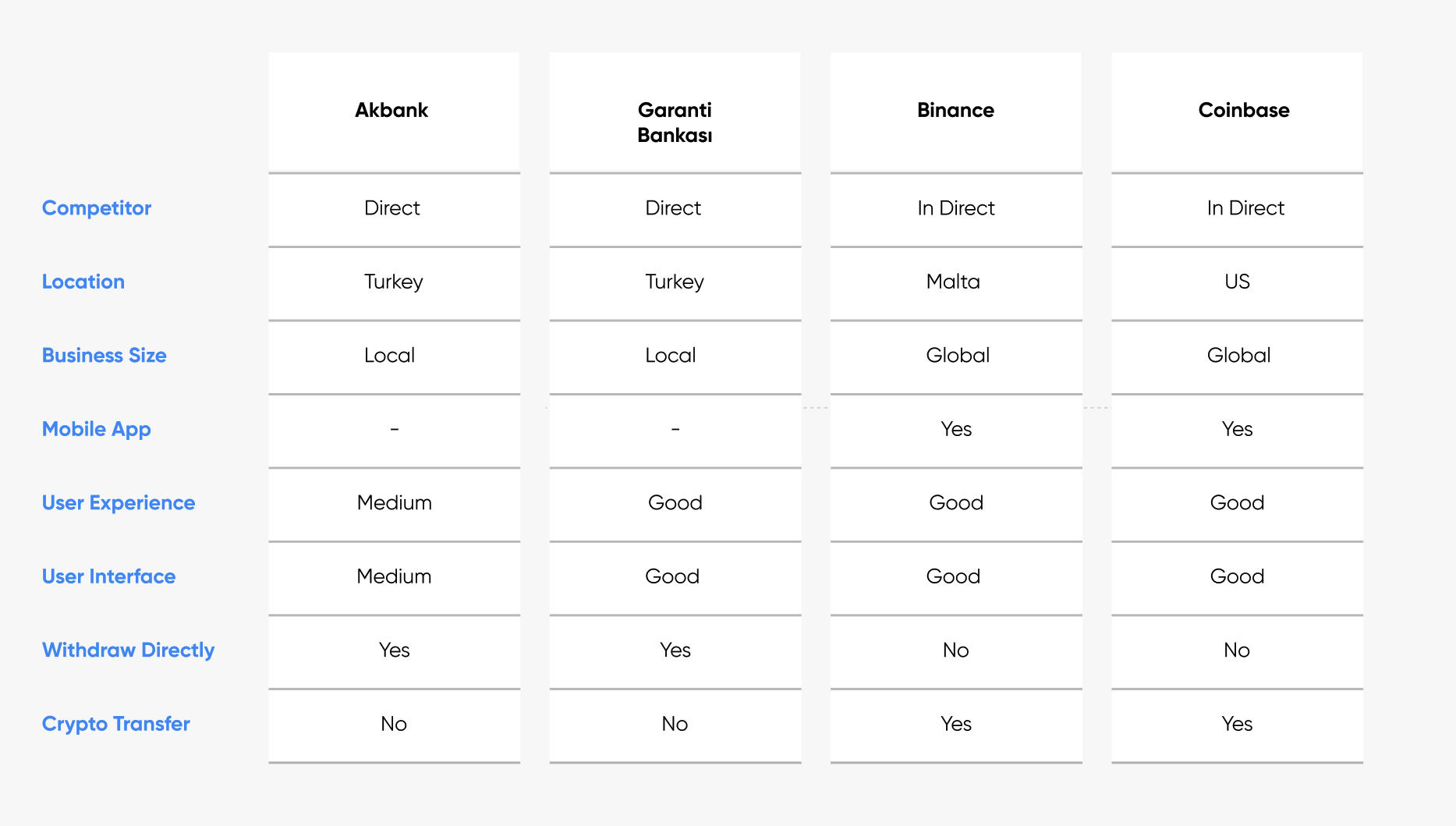

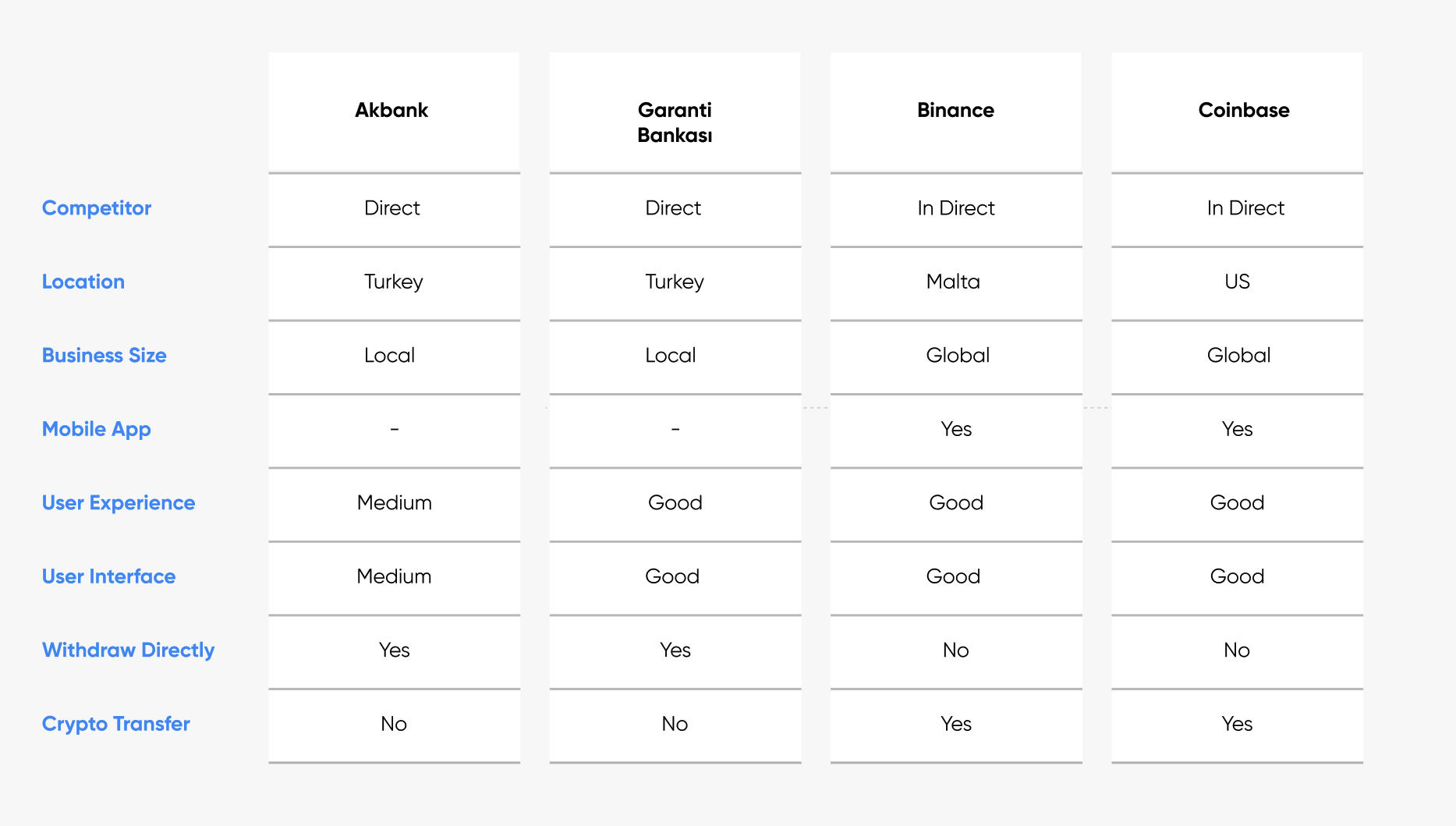

Competitor Analysis

From our analysis, our local competitors dont allowed their users to buy, sell and transfer crypto within their banking app. These are the other features that i was able to take into consideration for design concepts.

Insights

- Local banks (Akbank, Garanti) lacked crypto support

- Global exchanges (Binance, Coinbase) offered services but lacked trust

- Opportunity: combine local bank trust with crypto usability

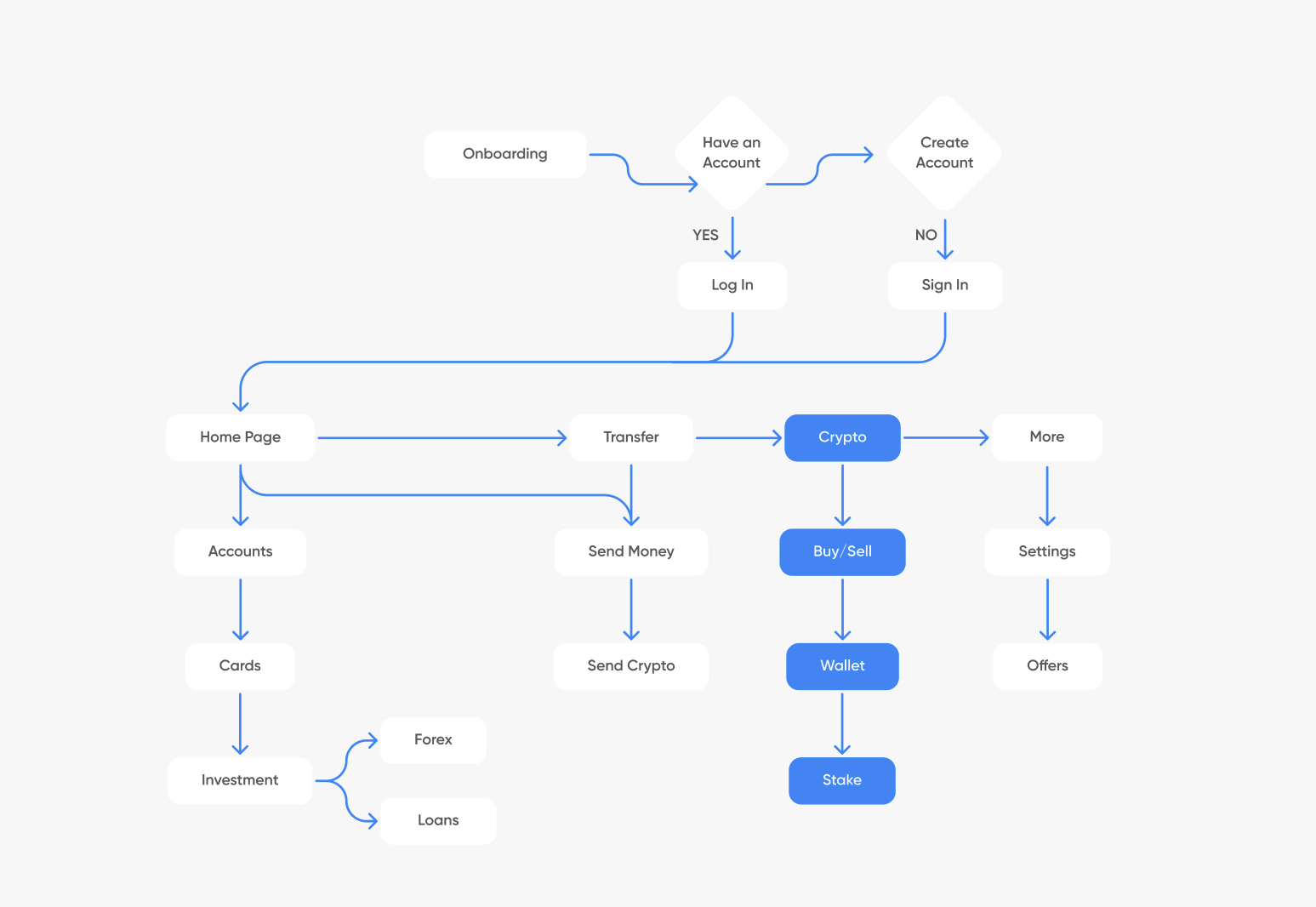

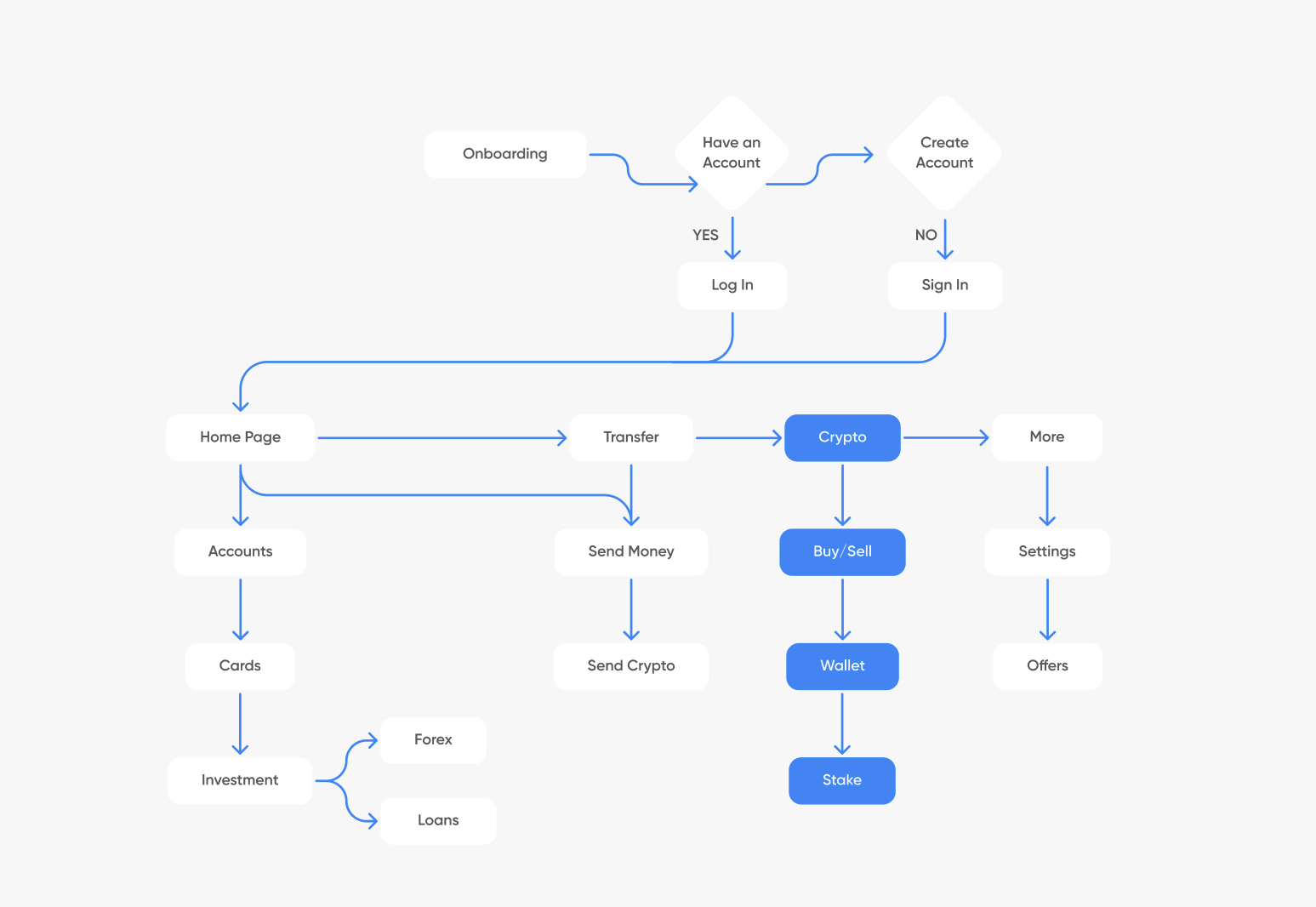

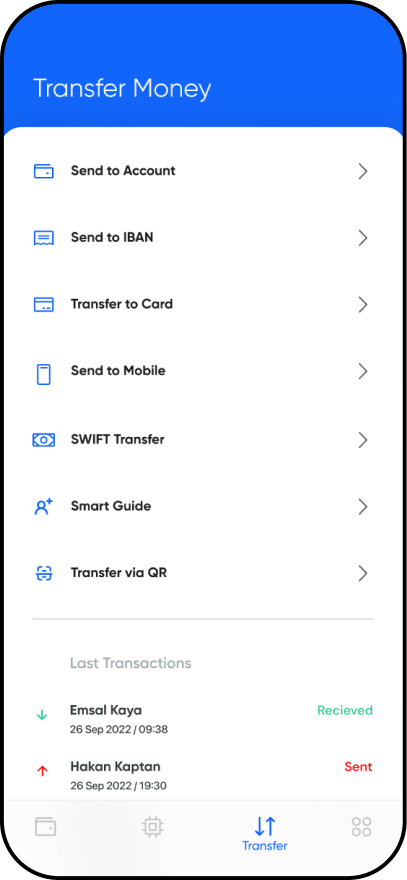

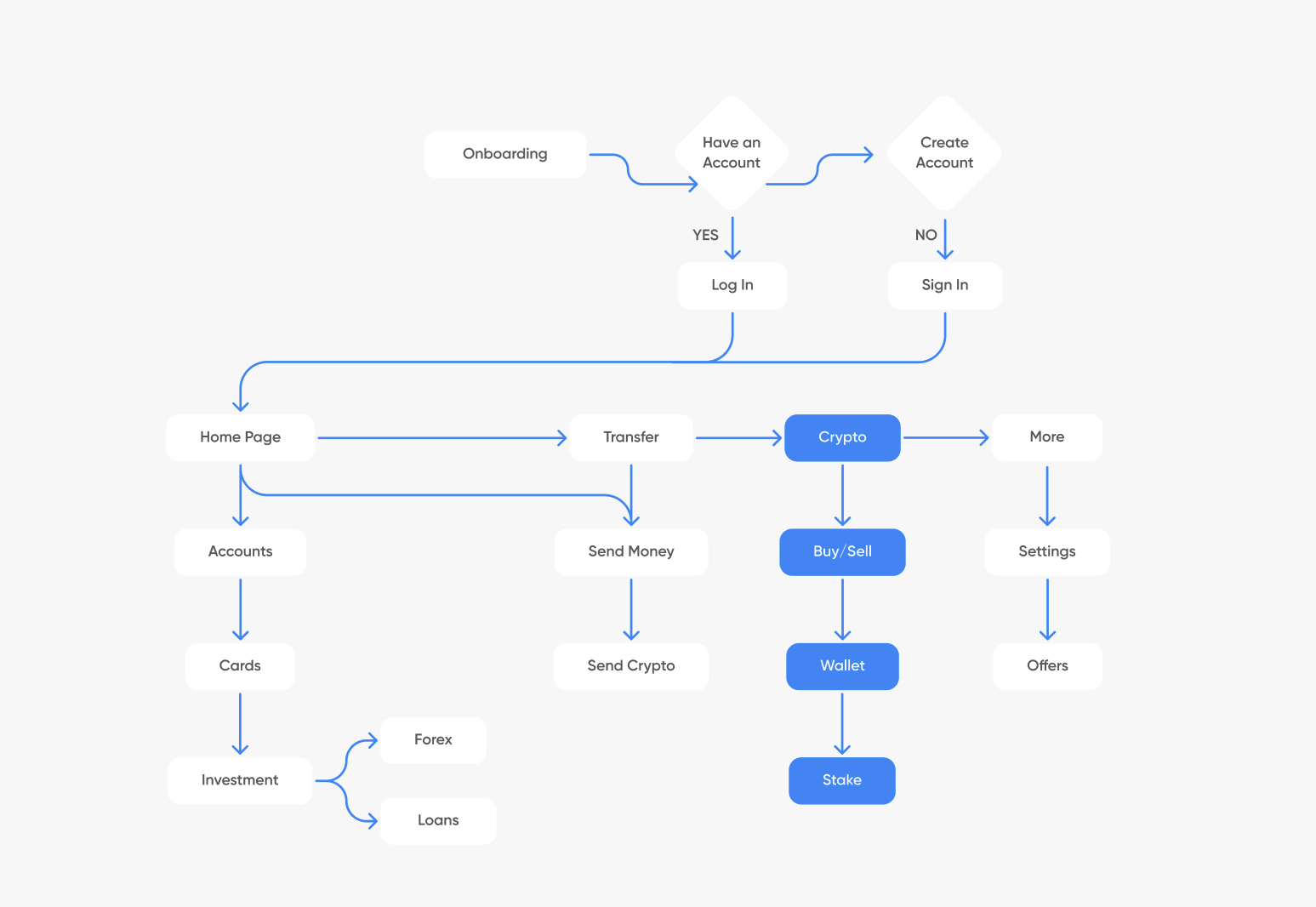

User Flow

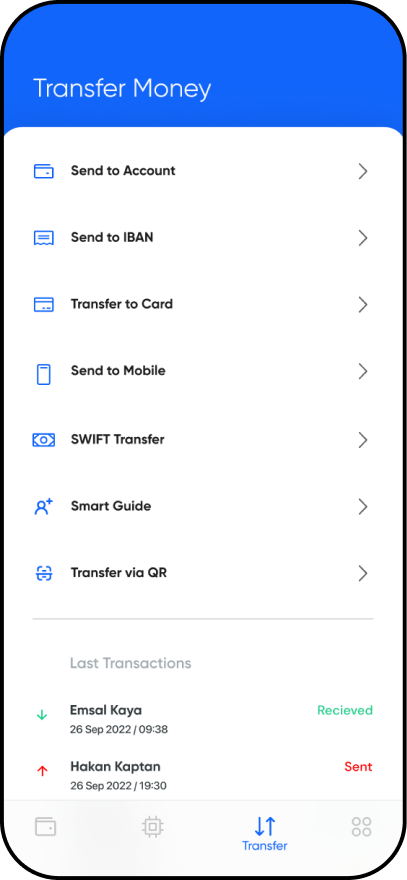

Mapped 4 key modules: Home, Transfer, Crypto, More → blending traditional banking flows with crypto actions.

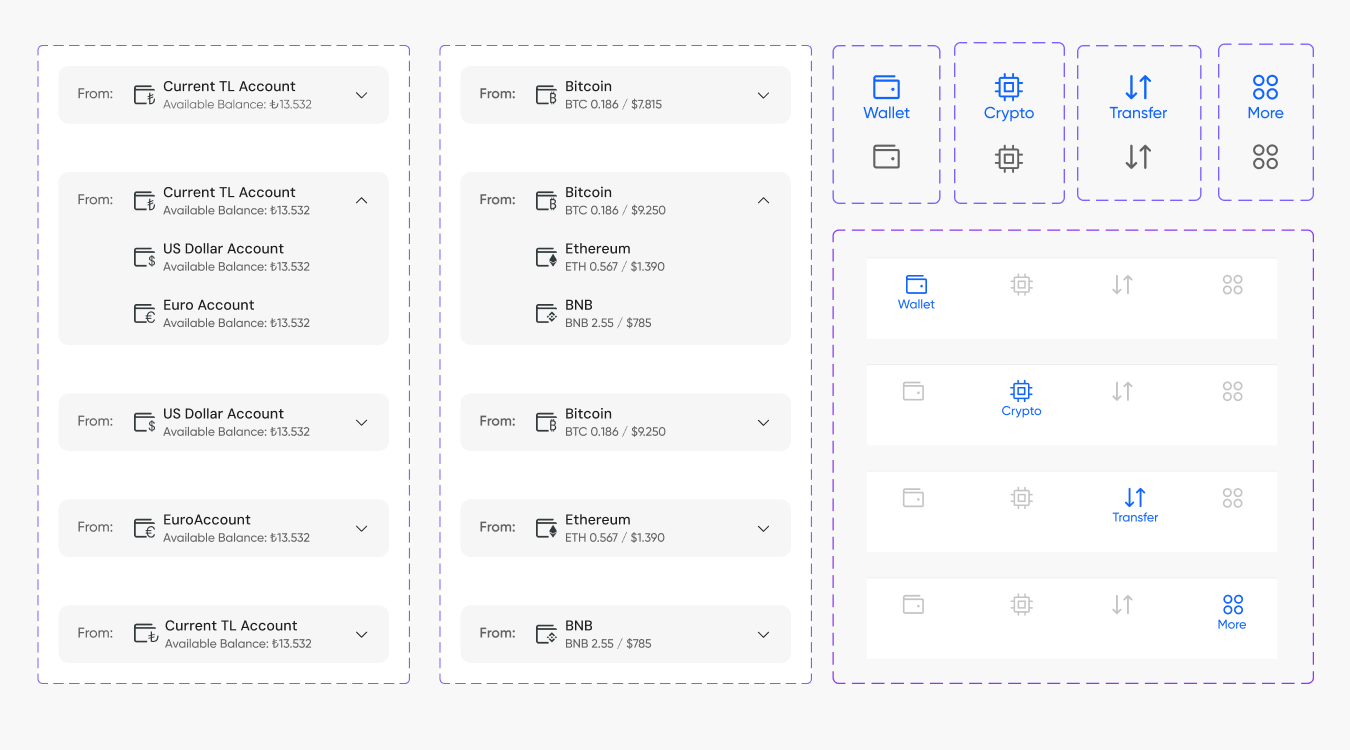

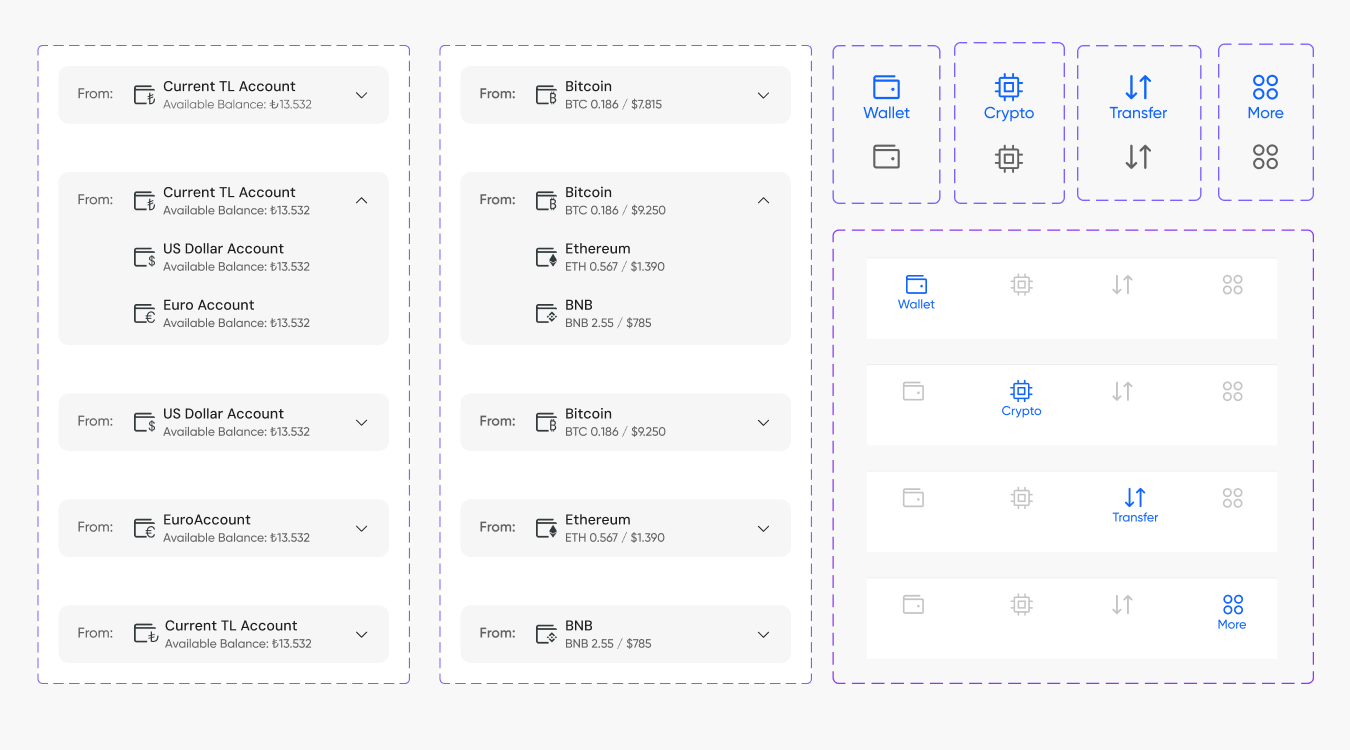

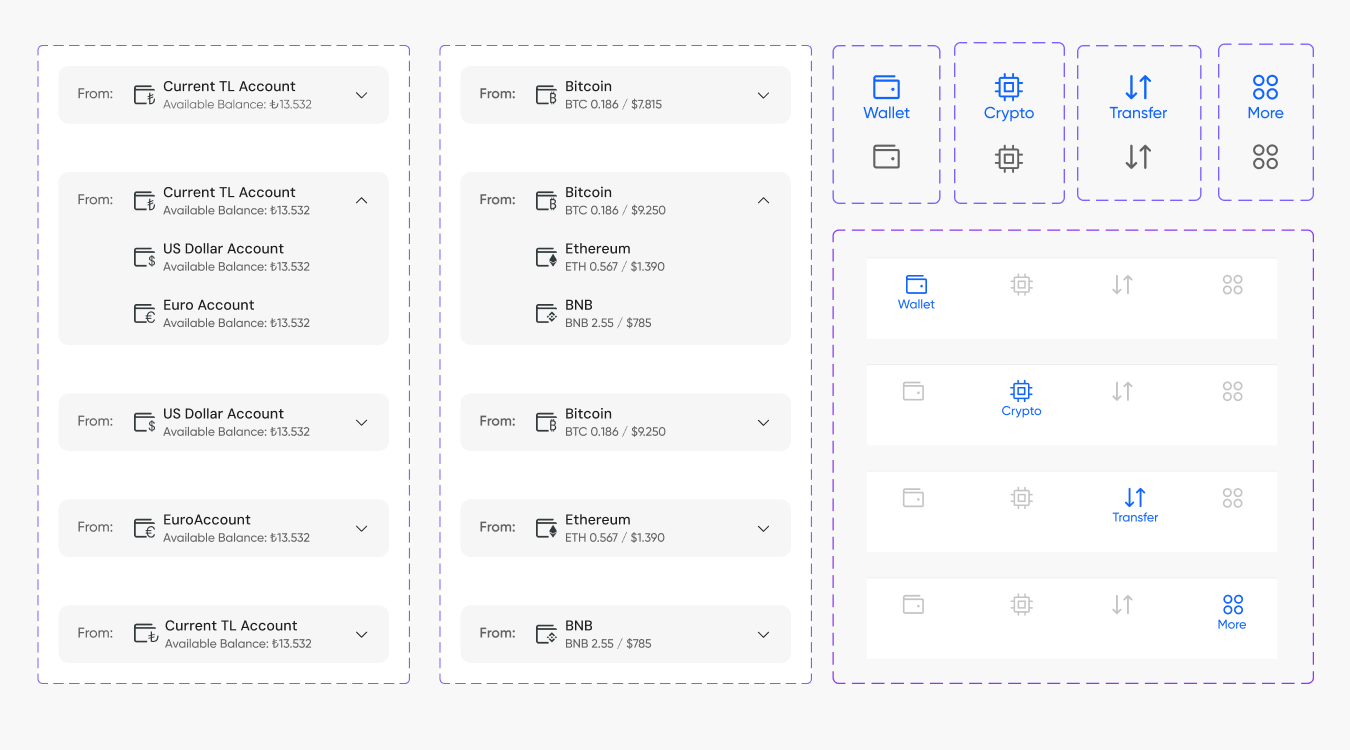

Wireframes

Early wireframes focused on simplified wallets, transparent flows, and reducing friction during onboarding.

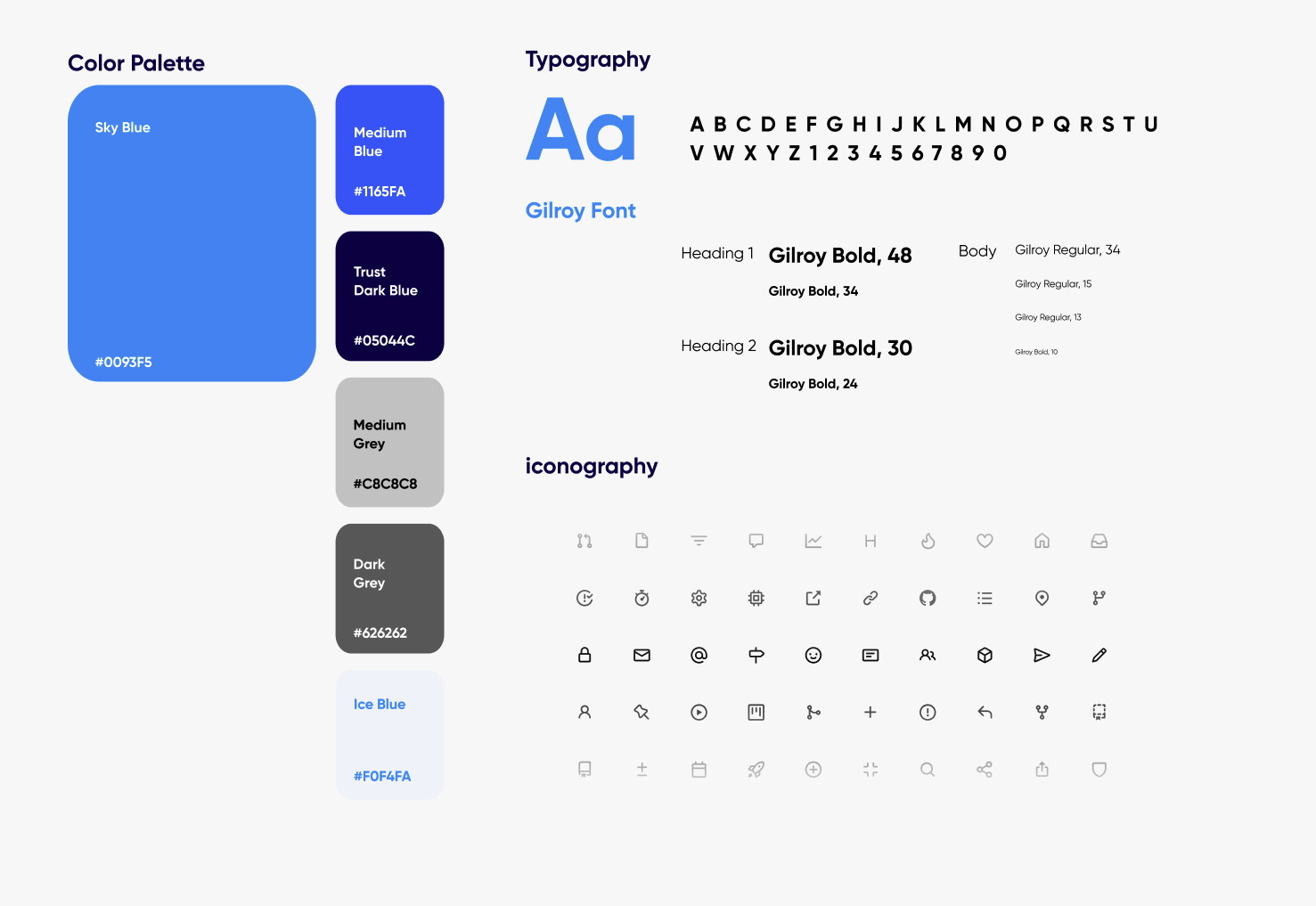

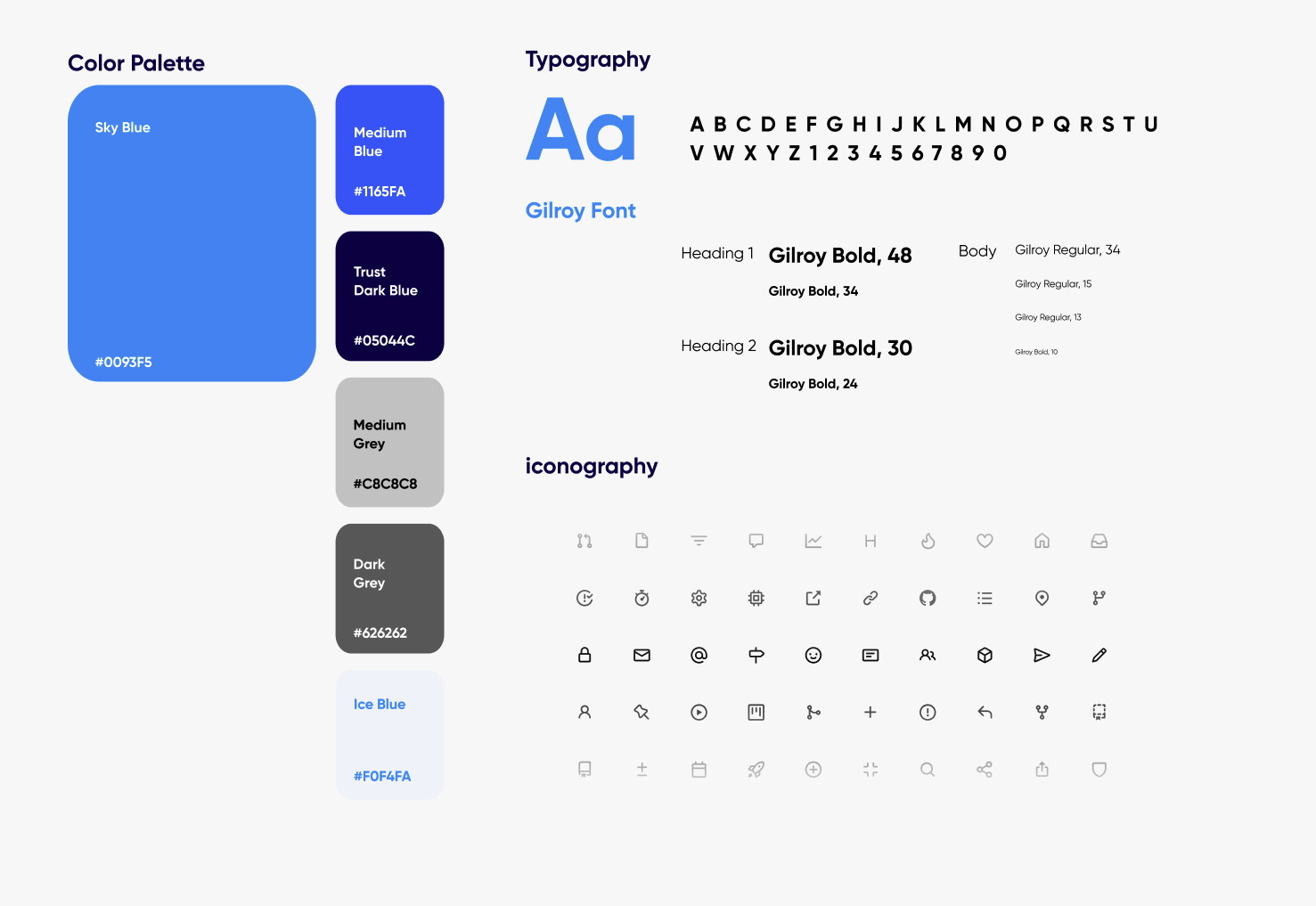

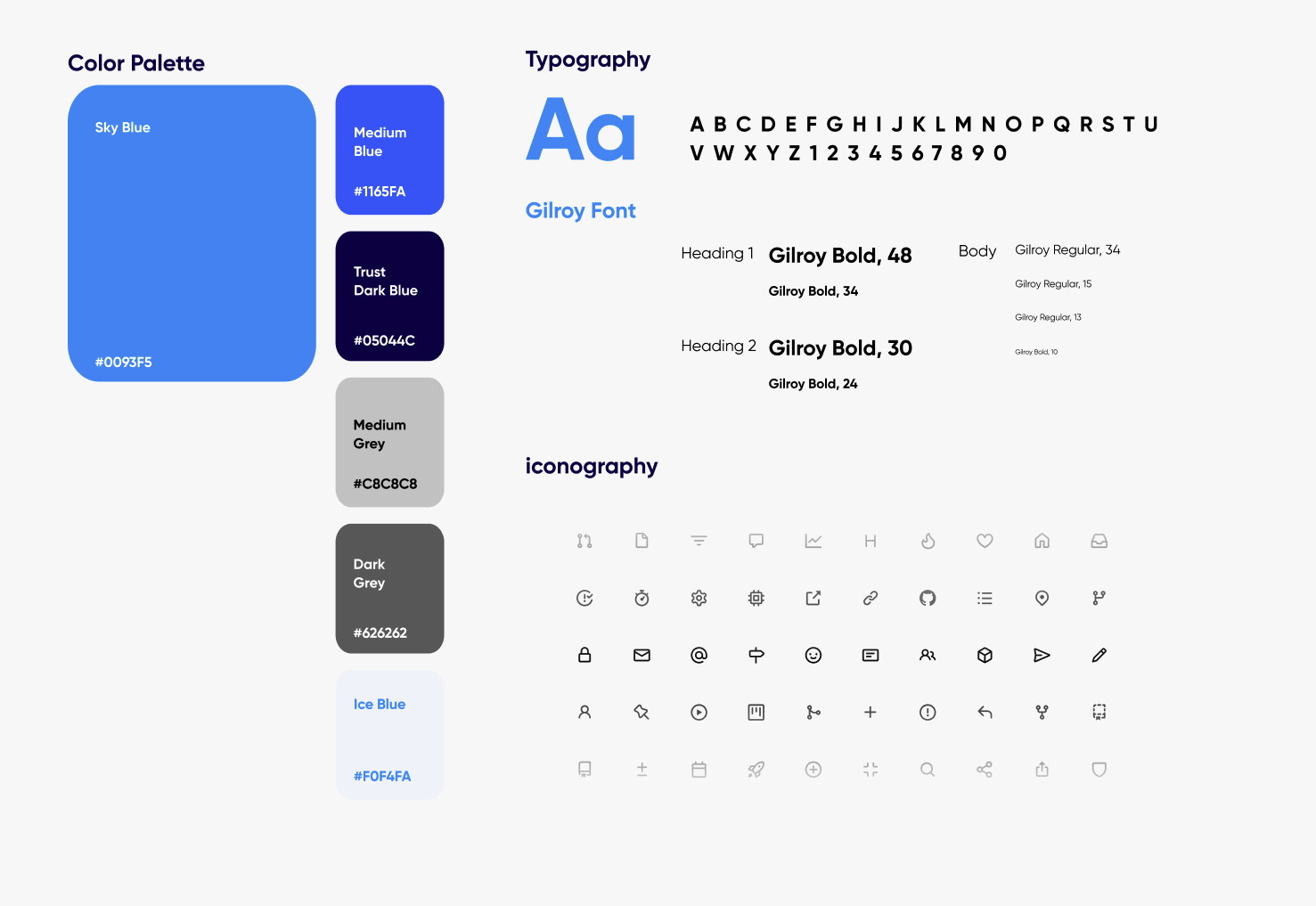

Design System

The design principle that subdivides a system into smaller parts called modules (atomic design principle), which can be indepentently created , modified, replaced or exchanged with other modules or between different system.

Component Library

A modular design system built with atomic principles, allowing components to be easily created, reused, and adapted across the app.

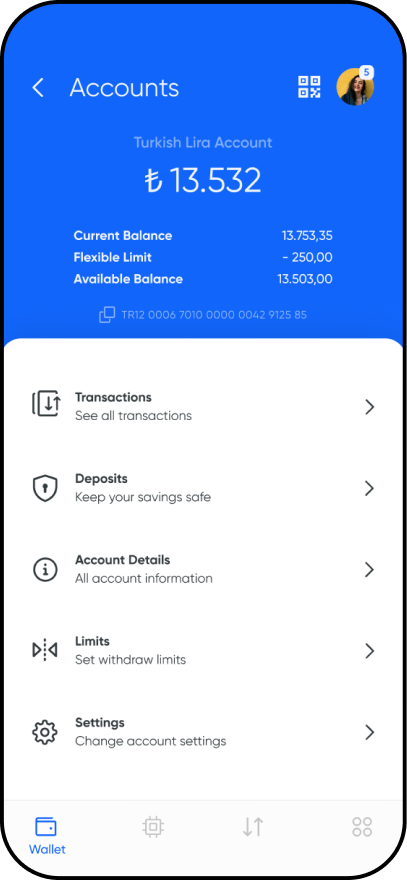

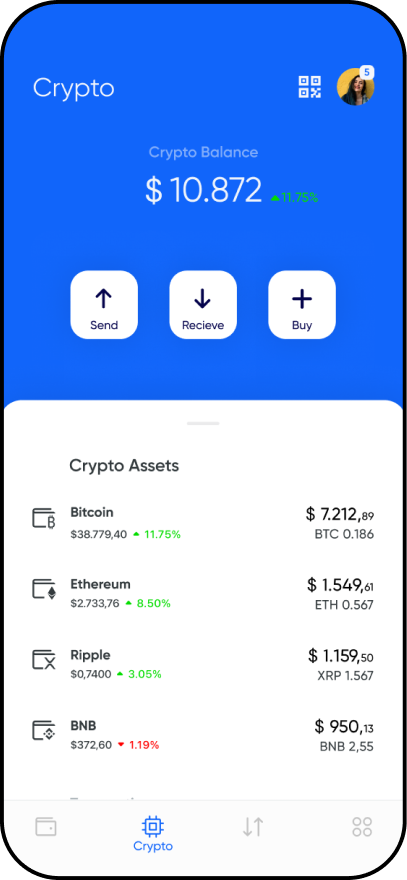

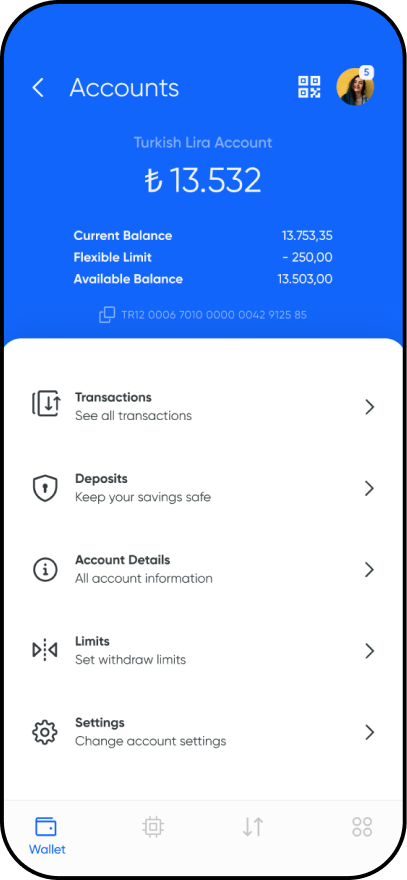

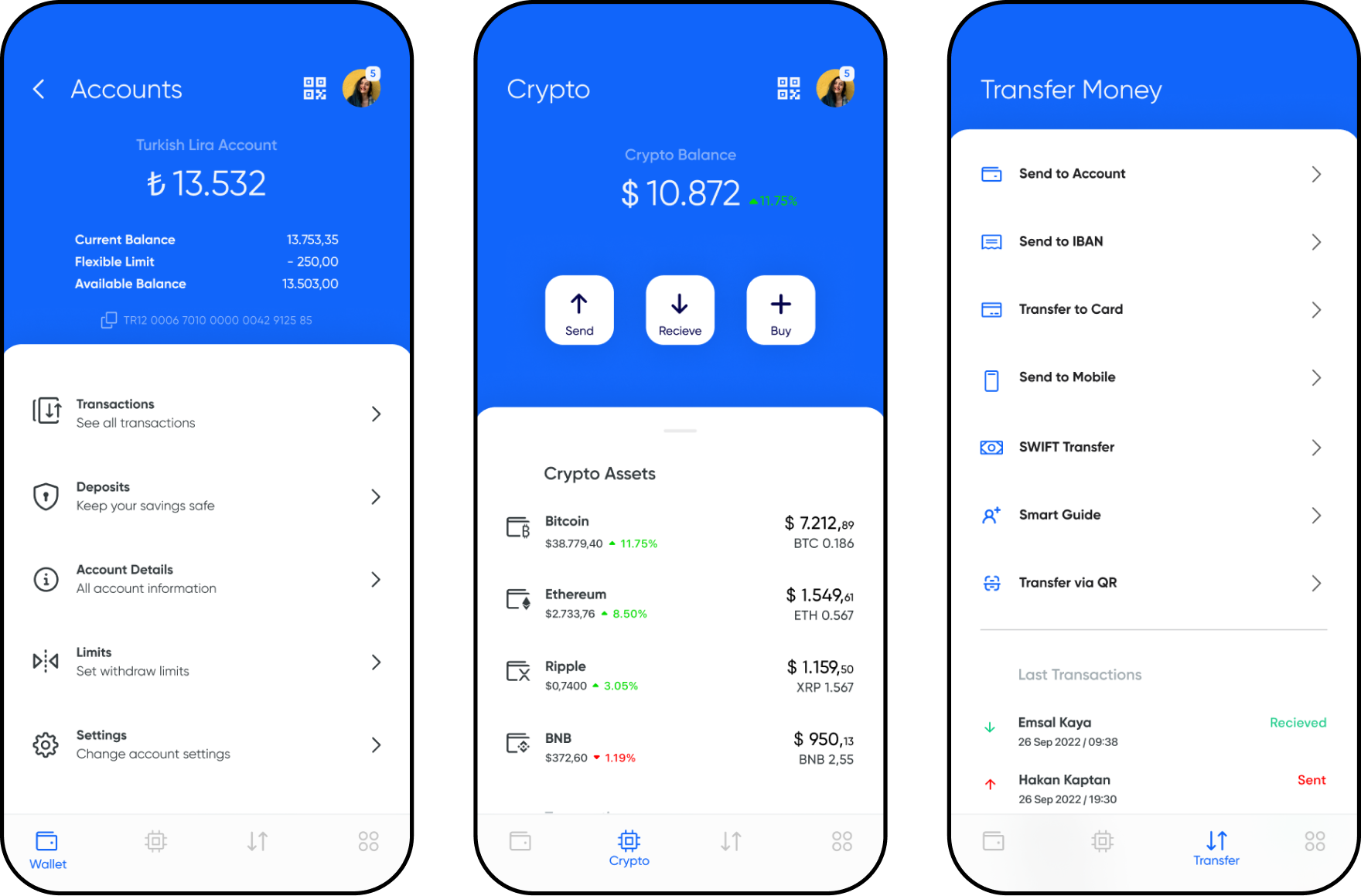

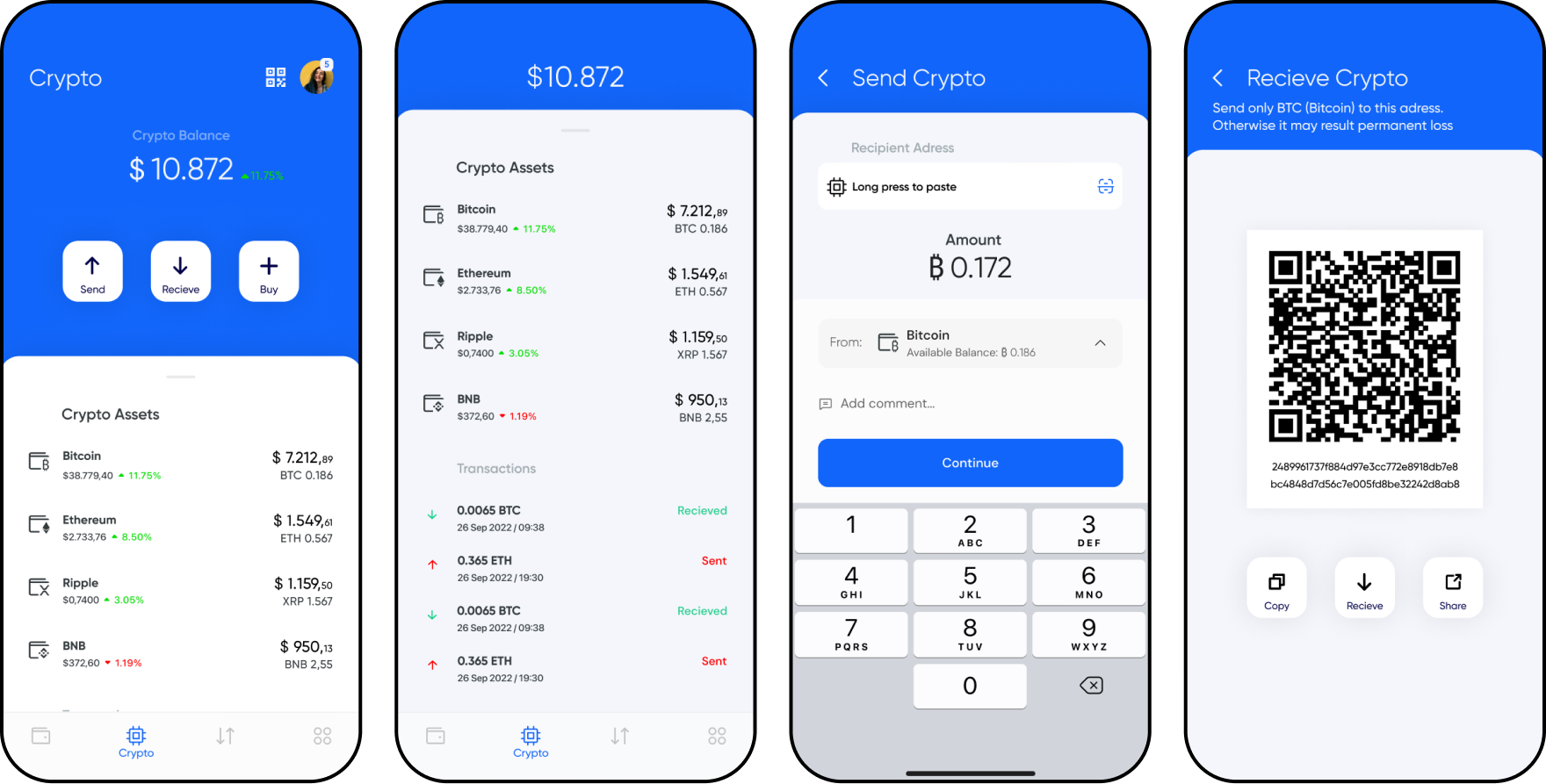

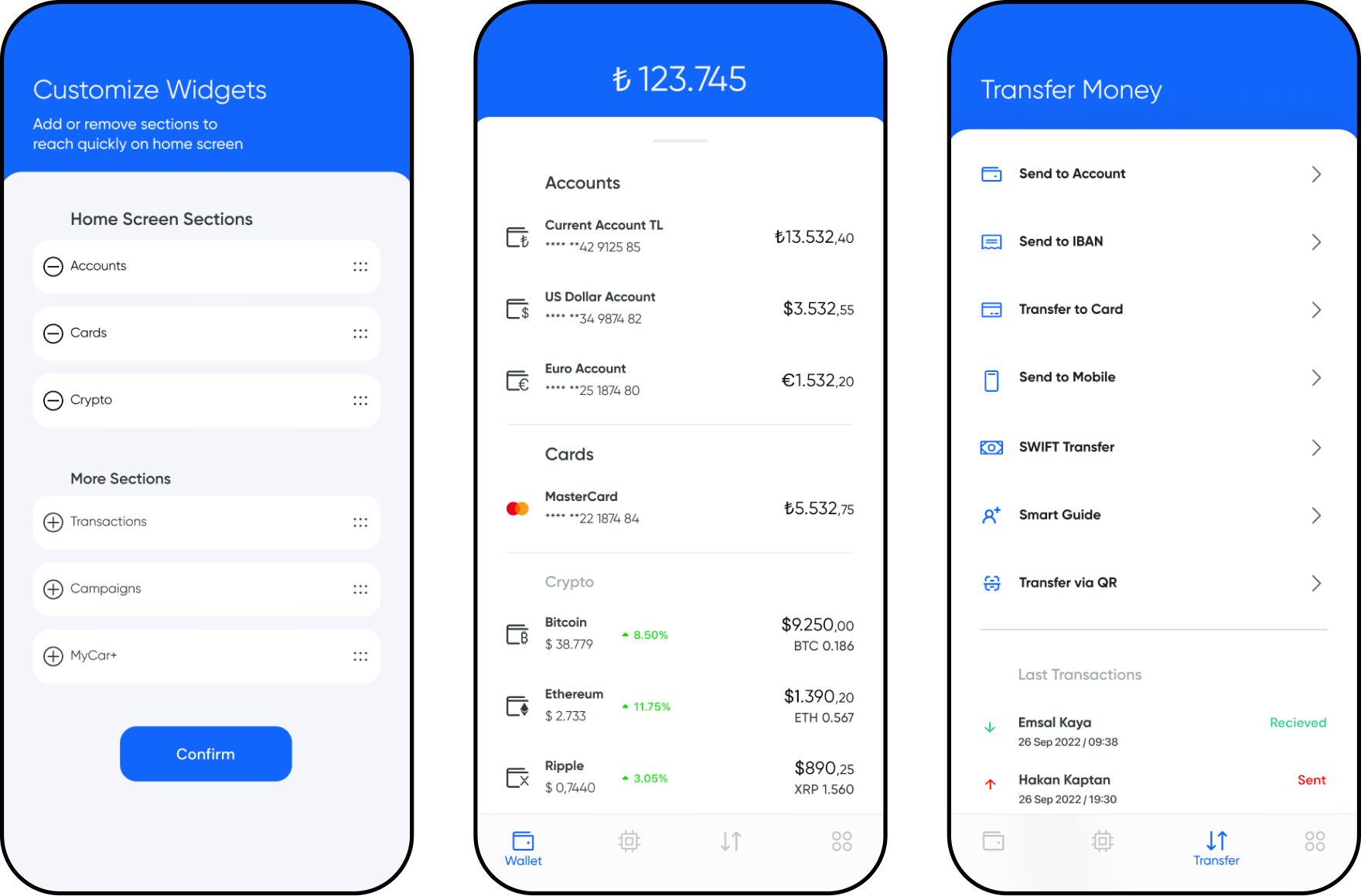

Final Screens

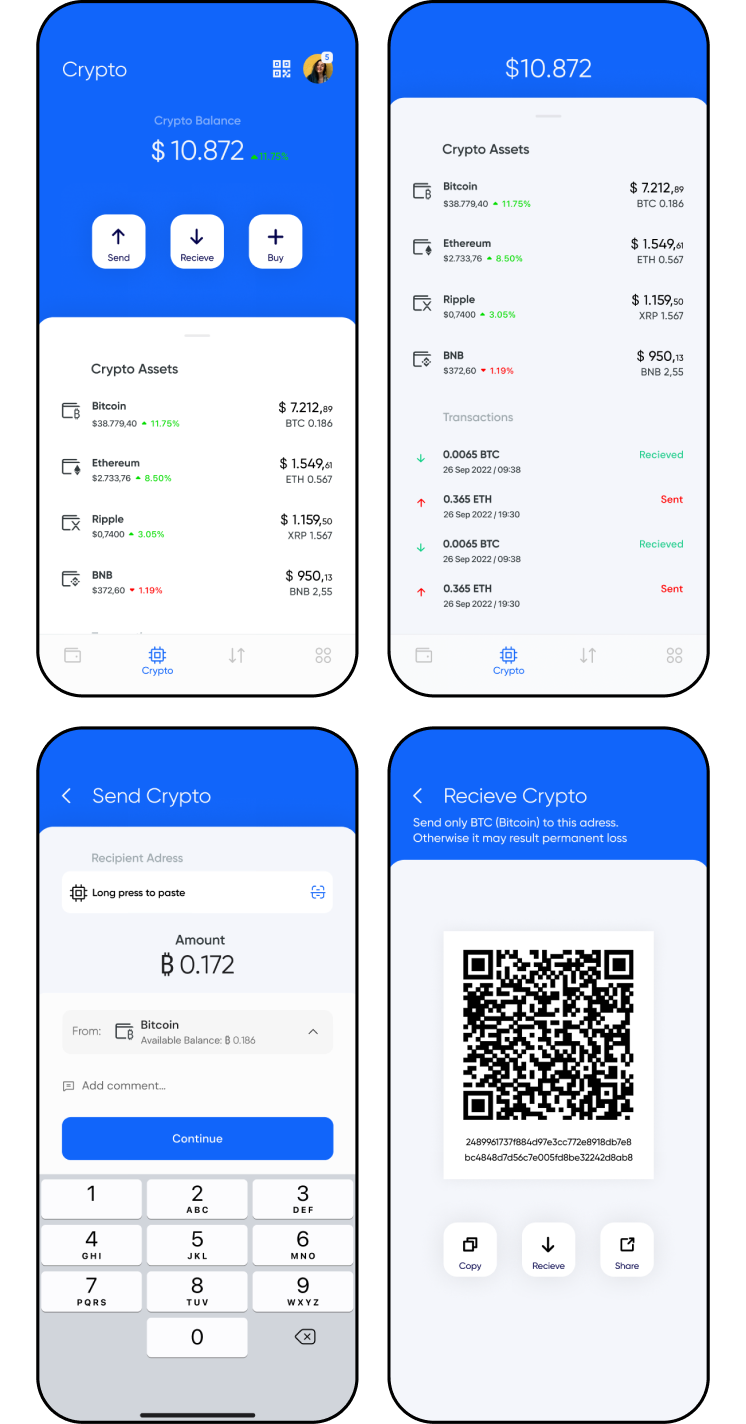

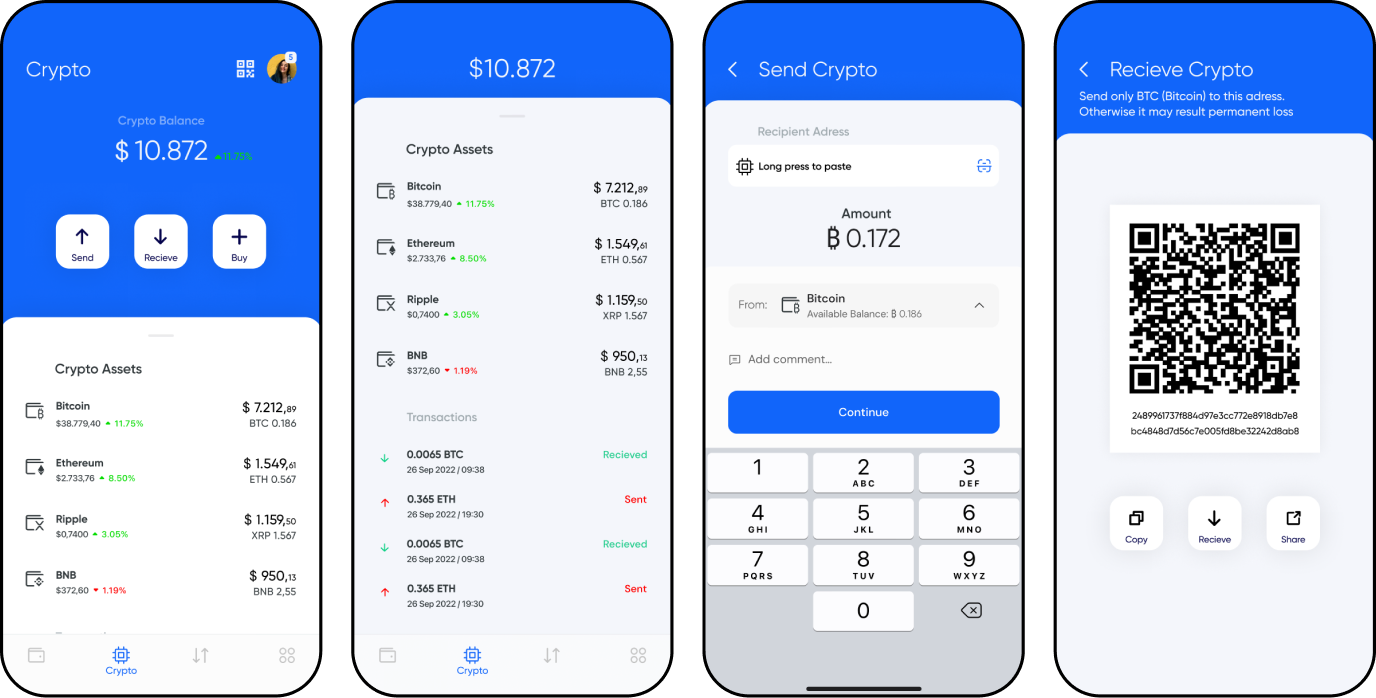

By placing “Crypto” next to core banking features, we ensured they can monitor and manage digital assets with the same ease as their traditional accounts.

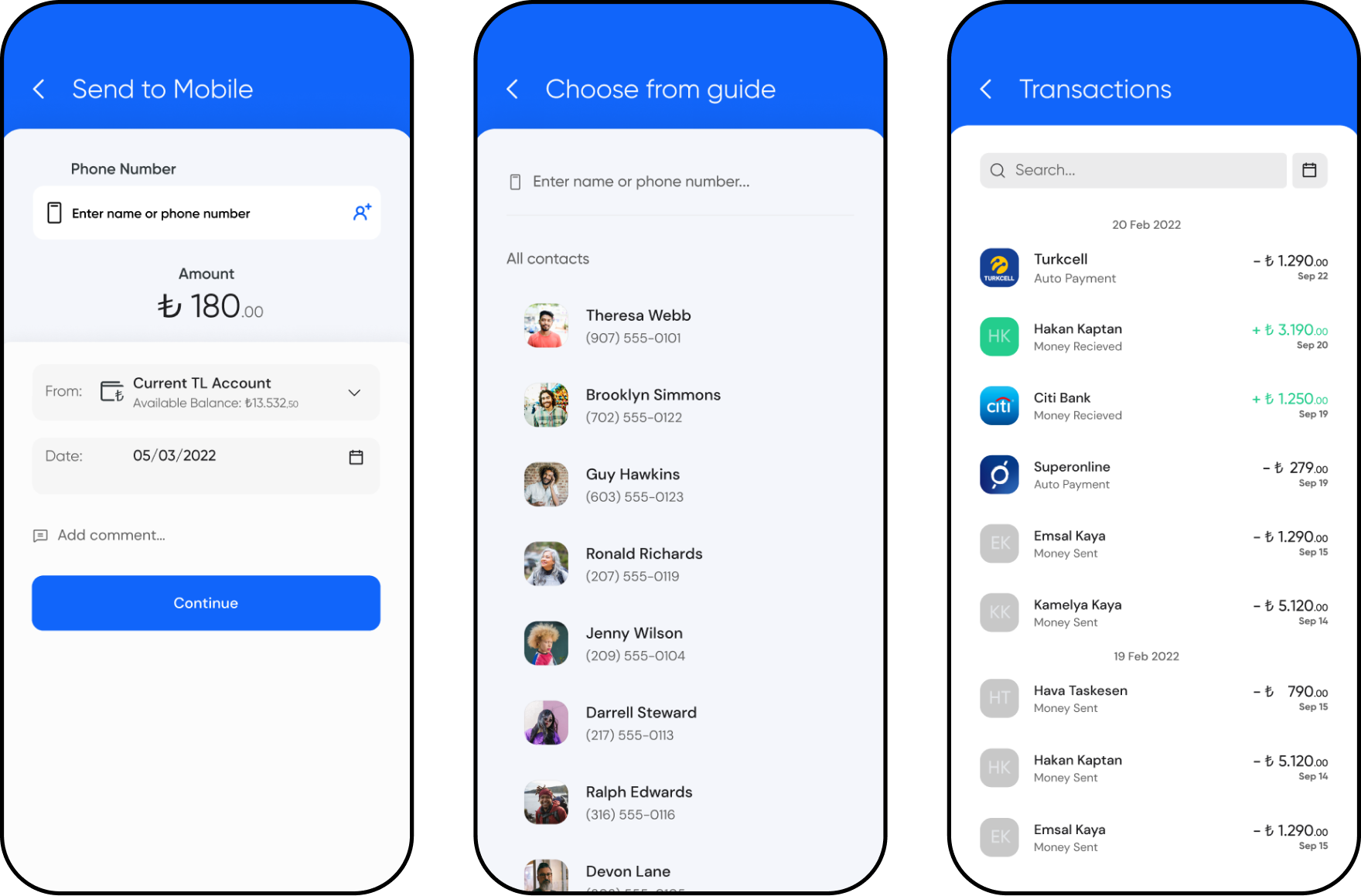

Usability testing showed that users often confused fiat and crypto transfers. To solve this, all crypto-related actions were grouped under the dedicated “Crypto” section in the navigation.

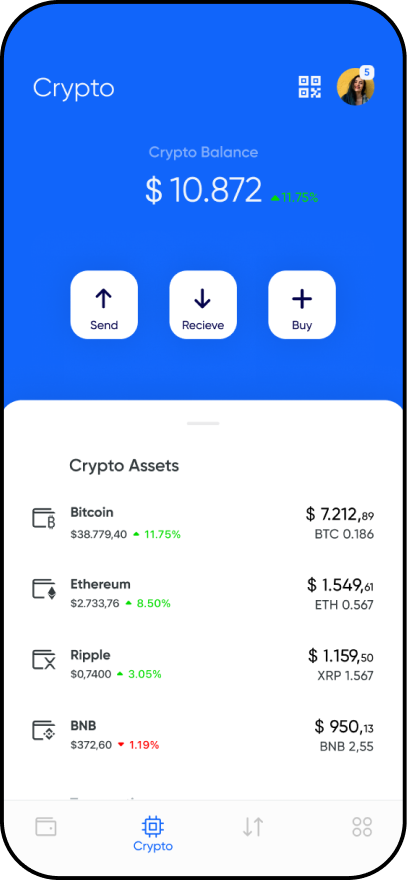

Users can quickly access balances and transaction history through a simple drawer view. From the same screen, they can send or receive crypto, or directly purchase digital assets using their fiat accounts within the bank.

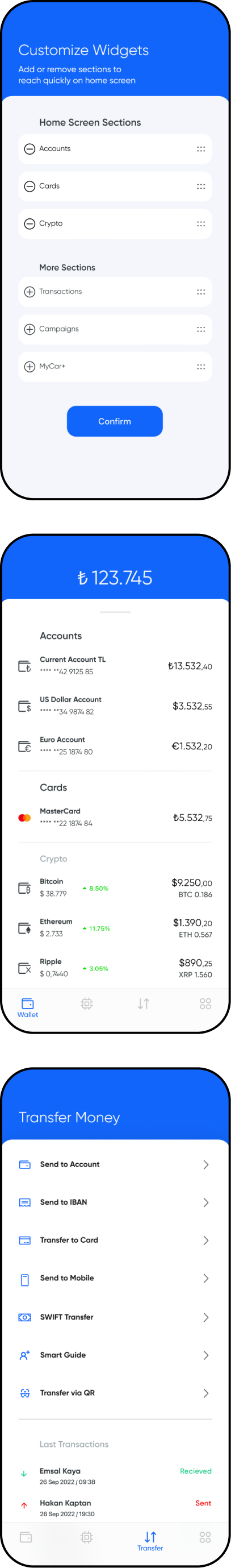

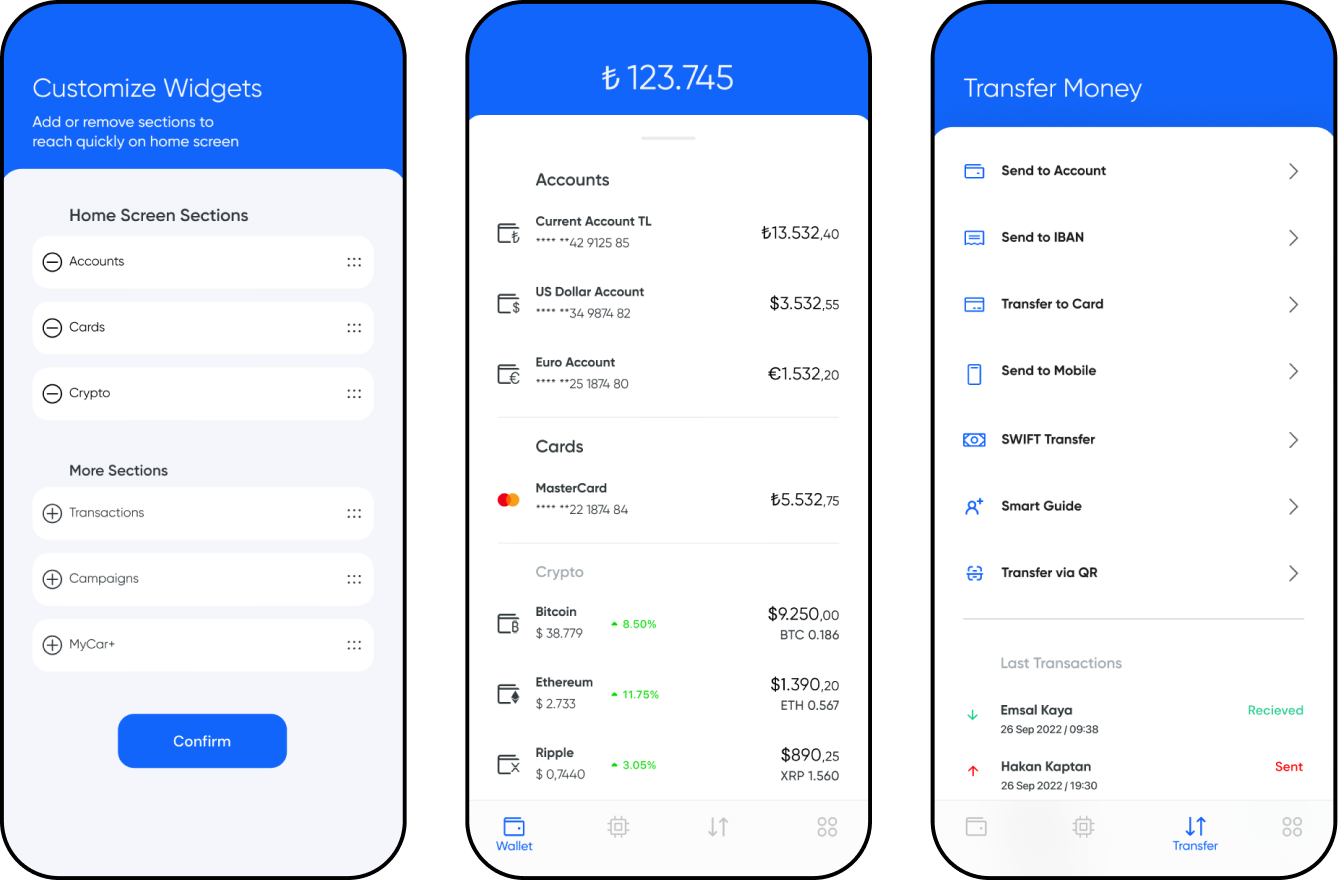

Customizable Widgets: Users can personalize the home screen by adding their most-used features like Accounts, Cards, or Crypto—creating a faster, tailored experience.

Drawer Access: Instead of switching between pages, a simple drawer lets users quickly check balances and manage transfers all in one place.

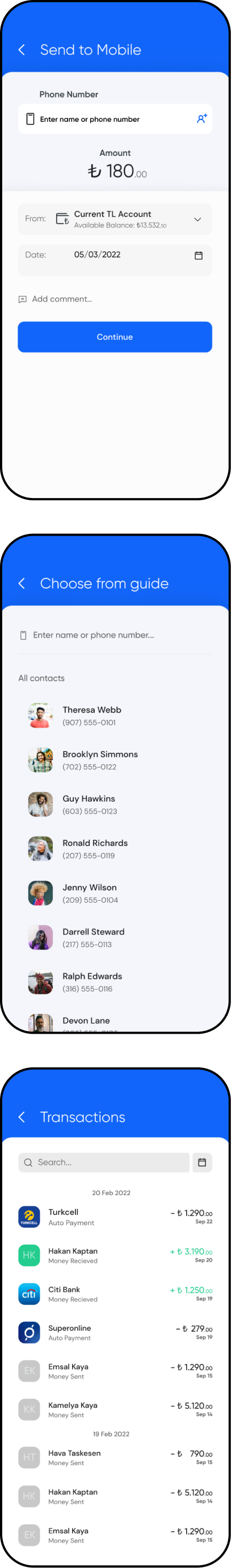

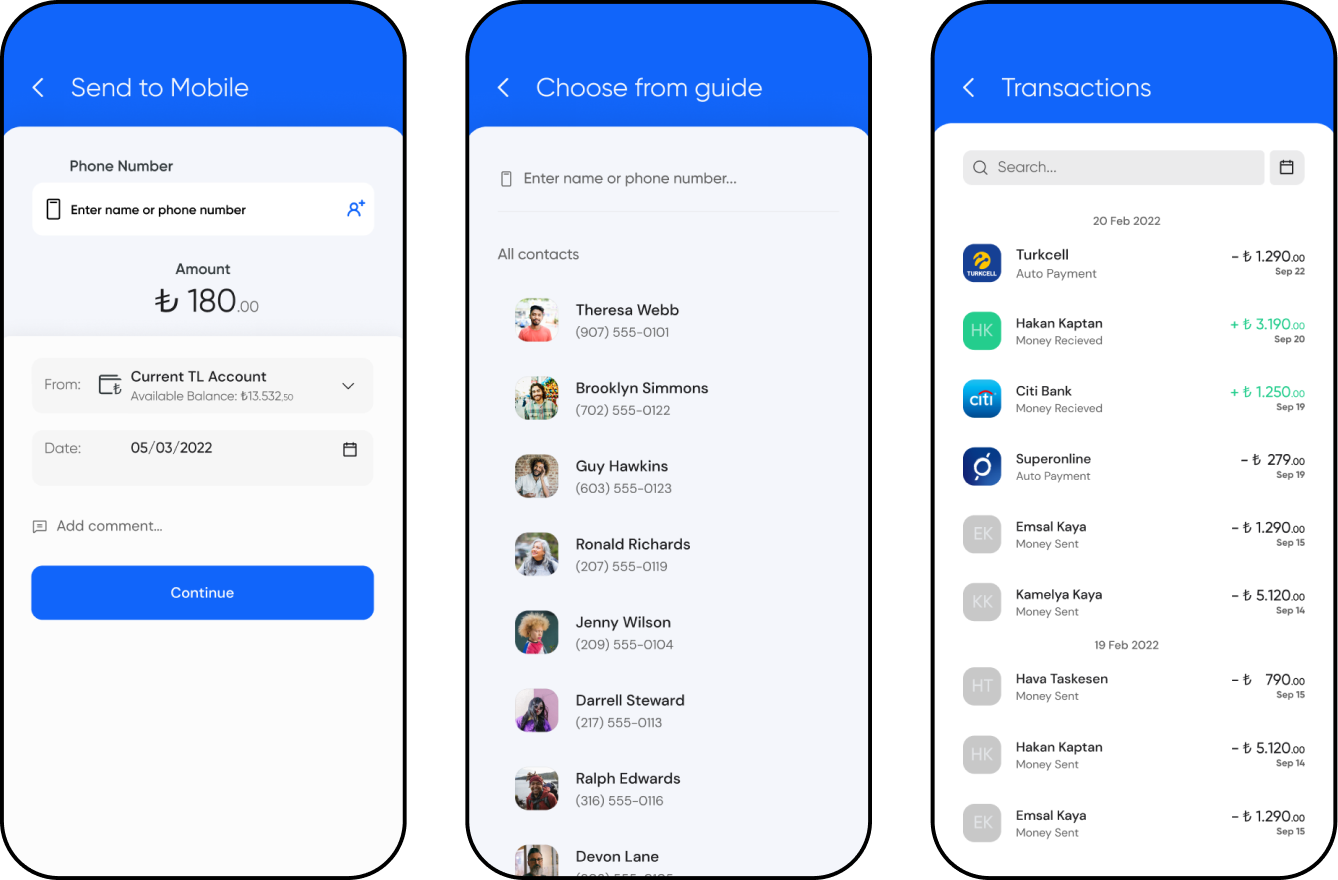

Testing showed that users prefer phone-based transfers over IBAN for speed and convenience, so we simplified the flow and connected it with their contact list.

Outcome

- A refreshed Yapı Kredi app that makes crypto as simple as banking

- Secure cold wallet integration, reducing trust barriers

- Modern UI aligned with the brand’s identity

- Clear market differentiator: first local bank to integrate crypto securely into everyday banking

Learnings

- Trust proved to be more important than advanced features. Users consistently prioritized security over anything else.

- Designing crypto flows to feel like traditional banking lowered the entry barrier and made adoption easier.

- User research highlighted that emotions matter. Fear and mistrust shaped design decisions more than technical challenges.

Let’s innovate

something together or at least die trying.

{i mean menthally 😉}

.skerimkaya

Copyright © Made with Coffee - Based on Earth

Crypto Banking

Category

Mobile app

Industry

Fintech

Role

Product Designer

Traditional banking meets crypto

Yapı Kredi, Turkey’s fourth largest bank, aimed to bring crypto into everyday banking. Despite being an early mover, the brand struggled to deliver a seamless experience—calling for a refreshed vision that connects trust with innovation.

Problem Statement

Although crypto adoption in Turkey is rising fast, users remain skeptical of existing platforms: exchanges are seen as unsafe, complex, and “casino-like.” Yapı Kredi faced the challenge of designing a trusted, simple, and secure crypto banking experience that could reassure customers while differentiating from both local banks and global exchanges.

Vision

The new app was designed with one clear vision: make crypto banking as easy and reliable as checking your balance.

- Buy, sell, transfer, and save crypto with zero fees

- Seamless cold wallet integration for maximum security

- Competitive yet intuitive design informed by research and benchmarks

Discovery

Research users and business requirements about crypto features. Determine task facing product and user to examine list of cases for application and base on that create the application architecture and navigation.

🔍

Project Goals

Minimizing the problems faced by the new comers for crypto ecosystem by creating an app

👥

User Goals

Buy, sell or transfer

crypto easy and secure way they used to

🎯

Target Users

Aimed for people who dont want to miss benefits of crypto investment.

User interviews

A user survey was conducted to determine how potencial customers thinking about crypto currencies. Some of their frustiration listed below

Key findings from our conversations

check

Complaints against crypto exchanges rise in globally

check

Confusion around safe storage

check

Exchanges described as “hard to use, easy to lose”

check

Security fears

User research

24 responses analyzed across 19 data points revealed core user groups:

👨💼

Young professionals & students

💰

High-income investors

💹

Forex traders

Persona

To synthesize my research findings and my target user's needs and goals, I established my primary persona, "Hakan". This persona will help inform my design process going forward, ensuring I make decisions with him in mind.

Empathy Map

To gain a deeper understanding for my primary user's wants and needs, I reviewed my notes and observations taken during my 1:1 interviews and developed this empathy map.

Competitor Analysis

From our analysis, our local competitors dont allowed their users to buy, sell and transfer crypto within their banking app. These are the other features that i was able to take into consideration for design concepts.

Insights

- Local banks (Akbank, Garanti) lacked crypto support

- Global exchanges (Binance, Coinbase) offered services but lacked trust

- Opportunity: combine local bank trust with crypto usability

User Flow

Mapped 4 key modules: Home, Transfer, Crypto, More → blending traditional banking flows with crypto actions.

Wireframes

Early wireframes focused on simplified wallets, transparent flows, and reducing friction during onboarding.

Design System

The design principle that subdivides a system into smaller parts called modules (atomic design principle), which can be indepentently created , modified, replaced or exchanged with other modules or between different system.

Component Library

A modular design system built with atomic principles, allowing components to be easily created, reused, and adapted across the app.

Final Screens

By placing “Crypto” next to core banking features, we ensured they can monitor and manage digital assets with the same ease as their traditional accounts.

Usability testing showed that users often confused fiat and crypto transfers. To solve this, all crypto-related actions were grouped under the dedicated “Crypto” section in the navigation.

Users can quickly access balances and transaction history through a simple drawer view. From the same screen, they can send or receive crypto, or directly purchase digital assets using their fiat accounts within the bank.

Customizable Widgets: Users can personalize the home screen by adding their most-used features like Accounts, Cards, or Crypto—creating a faster, tailored experience.

Drawer Access: Instead of switching between pages, a simple drawer lets users quickly check balances and manage transfers all in one place.

Testing showed that users prefer phone-based transfers over IBAN for speed and convenience, so we simplified the flow and connected it with their contact list.

Outcome

- A refreshed Yapı Kredi app that makes crypto as simple as banking

- Secure cold wallet integration, reducing trust barriers

- Modern UI aligned with the brand’s identity

- Clear market differentiator: first local bank to integrate crypto securely into everyday banking

Learnings

- Trust proved to be more important than advanced features. Users consistently prioritized security over anything else.

- Designing crypto flows to feel like traditional banking lowered the entry barrier and made adoption easier.

- User research highlighted that emotions matter. Fear and mistrust shaped design decisions more than technical challenges.

Available for Remote or Onsite

Let’s innovate

something together or at least die trying.

{i mean menthally 😉}

.skerimkaya

Copyright © Made with Coffee - Based on Earth

Crypto Banking

Category

Mobile app

Industry

Fintech

Role

Product Designer

Traditional banking meets crypto

Yapı Kredi, Turkey’s fourth largest bank, aimed to bring crypto into everyday banking. Despite being an early mover, the brand struggled to deliver a seamless experience—calling for a refreshed vision that connects trust with innovation.

Problem Statement

Although crypto adoption in Turkey is rising fast, users remain skeptical of existing platforms: exchanges are seen as unsafe, complex, and “casino-like.” Yapı Kredi faced the challenge of designing a trusted, simple, and secure crypto banking experience that could reassure customers while differentiating from both local banks and global exchanges.

Vision

The new app was designed with one clear vision: make crypto banking as easy and reliable as checking your balance.

- Buy, sell, transfer, and save crypto with zero fees

- Seamless cold wallet integration for maximum security

- Competitive yet intuitive design informed by research and benchmarks

Discovery

Research users and business requirements about crypto features. Determine task facing product and user to examine list of cases for application and base on that create the application architecture and navigation.

🔍

Project Goals

Minimizing the problems faced by the new comers for crypto ecosystem by creating an app

👥

User Goals

Buy, sell or transfer

crypto easy and secure way they used to

🎯

Target Users

Aimed for people who dont want to miss benefits of crypto investment.

User interviews

A user survey was conducted to determine how potencial customers thinking about crypto currencies. Some of their frustiration listed below

Key findings from our conversations

check

Complaints against crypto exchanges rise in globally

check

Confusion around safe storage

check

Exchanges described as “hard to use, easy to lose”

check

Security fears

User research

24 responses analyzed across 19 data points revealed core user groups:

👨💼

Young professionals & students

💰

High-income investors

💹

Forex traders

Persona

To synthesize my research findings and my target user's needs and goals, I established my primary persona, "Hakan". This persona will help inform my design process going forward, ensuring I make decisions with him in mind.

Empathy Map

To gain a deeper understanding for my primary user's wants and needs, I reviewed my notes and observations taken during my 1:1 interviews and developed this empathy map.

Competitor Analysis

From our analysis, our local competitors dont allowed their users to buy, sell and transfer crypto within their banking app. These are the other features that i was able to take into consideration for design concepts.

Insights

- Local banks (Akbank, Garanti) lacked crypto support

- Global exchanges (Binance, Coinbase) offered services but lacked trust

- Opportunity: combine local bank trust with crypto usability

User Flow

Mapped 4 key modules: Home, Transfer, Crypto, More → blending traditional banking flows with crypto actions.

Wireframes

Early wireframes focused on simplified wallets, transparent flows, and reducing friction during onboarding.

Design System

The design principle that subdivides a system into smaller parts called modules (atomic design principle), which can be indepentently created , modified, replaced or exchanged with other modules or between different system.

Component Library

A modular design system built with atomic principles, allowing components to be easily created, reused, and adapted across the app.

Final Screens

By placing “Crypto” next to core banking features, we ensured they can monitor and manage digital assets with the same ease as their traditional accounts.

Usability testing showed that users often confused fiat and crypto transfers. To solve this, all crypto-related actions were grouped under the dedicated “Crypto” section in the navigation.

Users can quickly access balances and transaction history through a simple drawer view. From the same screen, they can send or receive crypto, or directly purchase digital assets using their fiat accounts within the bank.

Customizable Widgets: Users can personalize the home screen by adding their most-used features like Accounts, Cards, or Crypto—creating a faster, tailored experience.

Drawer Access: Instead of switching between pages, a simple drawer lets users quickly check balances and manage transfers all in one place.

Testing showed that users prefer phone-based transfers over IBAN for speed and convenience, so we simplified the flow and connected it with their contact list.

Outcome

- A refreshed Yapı Kredi app that makes crypto as simple as banking

- Secure cold wallet integration, reducing trust barriers

- Modern UI aligned with the brand’s identity

- Clear market differentiator: first local bank to integrate crypto securely into everyday banking

Learnings

- Trust proved to be more important than advanced features. Users consistently prioritized security over anything else.

- Designing crypto flows to feel like traditional banking lowered the entry barrier and made adoption easier.

- User research highlighted that emotions matter. Fear and mistrust shaped design decisions more than technical challenges.

Available for Remote or Onsite

Let’s innovate

something together or at least die trying.

{i mean menthally 😉}

Sukru Kerim Kaya

Lead Product Designer

Contact me

grafikaya@gmail.com

Currently open to full-time opportunities (remote or on-site). Especially interested in AI, fintech, Proptech and future-facing SaaS products.

Let's talk

.skerimkaya

Copyright © Made with Coffee - Based on Earth